Car insurance is one of those things you need to have but hope you never have to use. In the stress and confusion following a car accident, the last thing you want to find out is that you’ve saved a few dollars on your insurance premium every month but lost the option to choose your own repairer.

This is why it’s crucial that you read the Product Disclosure Statement (PDS) carefully when you select your insurance policy. You need to know exactly what you’re agreeing to, and what you’re entitled to in the event of an accident.

What is ‘insurer preferred’ vs ‘choice of repairer’?

When you buy an insurance policy that stipulates a ‘preferred repairer,’ what this means is that your insurer will send your vehicle to the repairer that they choose – usually one that they already have an existing agreement with. On the other hand, paying a little extra on your insurance premium each month and making sure you have ‘choice of repairer’ could give you the freedom to select the repairer that you would like to use so you can ensure you receive high-quality repairs close to where you live. Make sure you check the conditions and limitations surrounding the ‘choice of repairer’ when you’re purchasing an insurance policy.

Is ‘choice of repairer’ important?

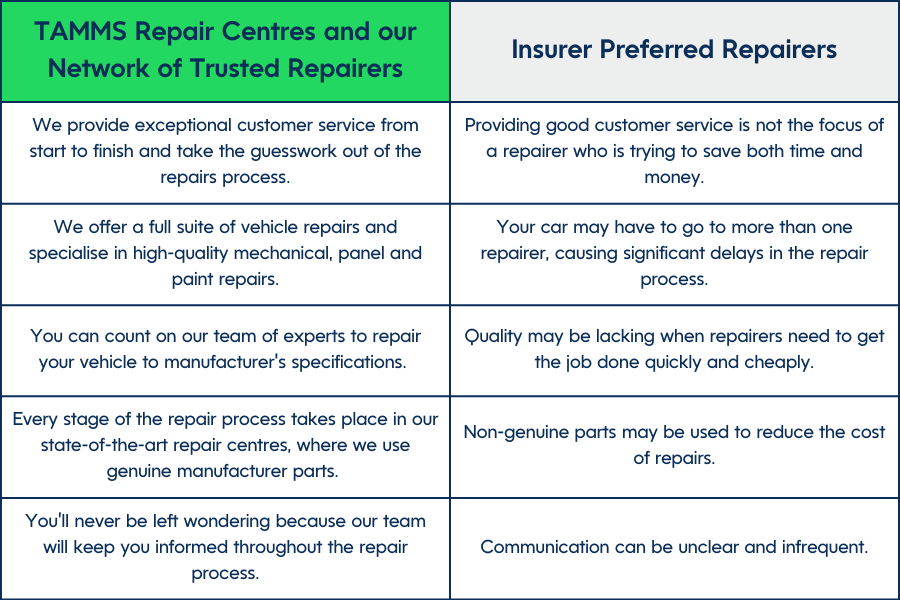

You might be wondering why you might need to have a ‘choice of repairer’ when using an ‘insurer preferred’ repairer is the cheaper option for your insurance premium. In many instances, when you select an ‘insurer preferred’ repairer, insurance companies may have an agreement in place with a repairer where a guaranteed flow of work is offered in exchange for repairs done at a lower cost. What this boils down to is that repairers end up cutting corners in line with the reduced time and costs allocated to each repair.

In short, it means you’re being disadvantaged because your car may not be repaired to manufacturer specifications and may not be fitted with genuine parts. Your insurer’s preferred repairer may also not have a branch that’s conveniently located for you – adding more stress to an already unpleasant situation.

If you’d like the option of being able to choose your trusted repairer to deliver first-rate work in a location that’s convenient for you, then, yes, having ‘choice of repairer’ is important.

Can an insurance company choose which panel shop repairs my car?

Depending on the insurance policy that you’ve taken out and the information provided in the Product Disclosure Statement (PDS), your insurer can send your car to their preferred repairer.

Sometimes, even if you’ve selected a policy with ‘choice of repairer,’ there are limitations and conditions surrounding this which allow your insurer to use their preferred repairer instead. Make sure you read the PDS carefully, so you know what you’re signing up for!

Can I choose who repairs my car after an accident?

Yes! The good news is that you can select to have ‘choice of repairer’ on your insurance policy. But keep in mind that not all insurance providers offer this option, and some insurers have limitations and conditions surrounding it.

Why choose TAMMS as your choice of repairer?

Taking your vehicle to a TAMMS Repair Centre means that you’ll receive expert repairs with genuine parts in our state-of-the-art facilities. At TAMMS, we don’t cut corners to save money and you can rely on our team of specialists to return your car to the state it was in before your accident. Our exceptional customer care will also take the stress out of the repairs process, so you know exactly what’s going on at every stage of your vehicle’s repair.

Experience the difference when you choose TAMMS to repair your car after an accident.